SNHS will be closed on Monday, February 19th!

We will see you Tuesday, February 20th!

Southern NH Services participates in Senator Shaheen’s Workforce Conversation, Feb. 5, 2024

2023 Community Needs Assessment

2023 Annual Report 2024 Calendar

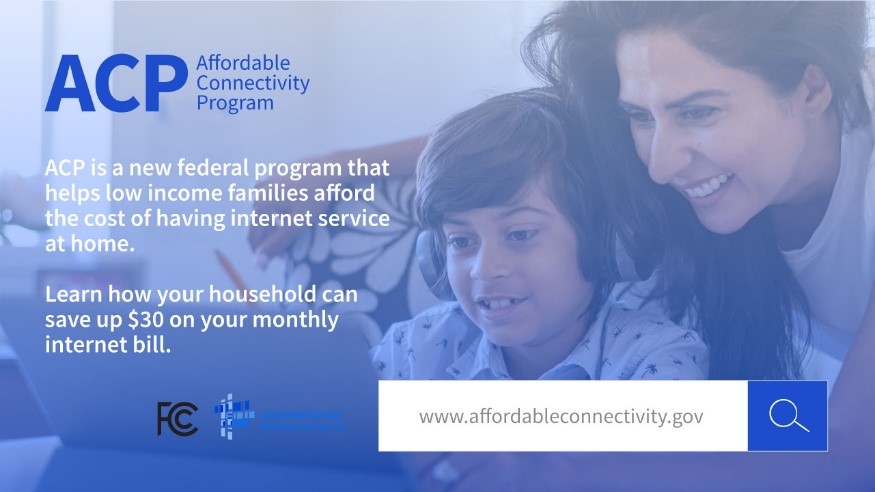

The Affordable Connectivity Program (ACP)

The Affordable Connectivity Program (ACP)

Making Information Equity Possible

What is the Affordable Connectivity Program?

July 2022 Newsletter

Program Spotlight: Early Childhood Apprenticeship Program

CONGRATULATIONS TO THE STAFF AT MONADNOCK COMMUNITY EARLY LEARNING CENTER

DOL/SNHS EARLY CHILDHOOD

APPRENTICSHIP PROGRAM

Ava Whicker and Ethan Jennings became the first recipients of the Department of Labor Child Care Developmental Specialist Certification through the Early Childhood Apprenticeship Program at Southern New Hampshire Services.

Ava and Ethan started their apprenticeship in March of 2021. Both are early childhood teachers at the Monadnock Community Early Learning Center in Peterborough, NH. During their time in the program they committed to 3,000 hours of on the job training and both earned a Child Development Associate from the Council for Professional Recognition.

Summer Food Service Program

Summer Food Service Program

The Summer Food Service Program (SFSP) ensures that at-risk children and teens have access to healthy meals and snacks during the summer months when school is not in session. During the school year, 22 million children receive free or reduced lunches – and this program was designed to fill the gap during the summer months for these children. Sponsored by the United States Department of Agriculture (USDA), the Summer Food Service Program provides breakfast, lunches and snacks in safe, supervised areas such as parks, pools and recreation centers for any child 18 years of age or younger that comes to the location. Southern New Hampshire Services has been a doorway to this program in Hillsborough and Rockingham Counties for 16 years, with sites in Manchester, Nashua and the Seacoast.

For more information, dates, and locations, click here

June 2022 Newsletter

Program Spotlight: Seniors Farmers Market

Summer weather is always good for a positive attitude boost, but fresh fruit and veggies? They go hand in hand! SNHS has been providing access to NH grown bundles of fruits and vegetables throughout the summer season. In fact, more than 1,240 seniors with low incomes were able to enjoy the tastes of summer last season. Thank you to all of the farmers who make maintaining a healthy lifestyle through diet a possibility for our clients!

For more information, click here

“Mrs. L looks forward to her summer appointment to receive her commodity food boxes because that’s when she receives her Farmers Market program bundle. Her favorite items she has received are corn on the cob, tomatoes, and peaches. Mrs. L said she is very thankful for the program because it is expensive to try to get farm fresh produce on a fixed income.

- Nutrition program staff

May 2022 Newsletter

May is Community Action Month!

Join us in celebrating the legacy and ongoing impact of the Community Action Network. Community Action changes people’s lives, embodies the spirit of hope, improves communities, and makes America a better place to live. We care about the entire community, and we are dedicated to helping people help themselves and each other.

"I have worked for SNHS for over 20 years. It has been a pleasure working with our elderly housing residents and contributing to the mission of the housing program. I take special pride in keeping our 3 housing sites in Rochester clean. This took on a special meaning to me during Covid- knowing I was helping keep people safe."

- Cindy Phillips (Housing)

April 2022 Newsletter

Program Spotlight: Senior Housing

Supportive housing for the elderly

As one of New Hampshire’s leading providers of housing to income eligible seniors, we are pleased to offer quality, affordable housing for the elderly throughout the state. We offer 910 apartments in 25 different elderly housing sites through funding provided by the U.S. Department of Housing and Urban Development’s Section 202 Supportive Housing Program. We have an additional four tax credit housing sites with funding from the New Hampshire Housing Finance Authority and Nashua Housing and Redevelopment Authority. Residents in these apartments pay 30% of their adjusted income for rent with the balance subsidized under HUD’s Section 8 Rental Assistance Program with heat and utilities included in the rent.

Fuel Assistance is Taking Applications Through May 2

FUEL ASSISTANCE TAKING APPLICATIONS THROUGH MAY 2

Southern NH Services’ Fuel Assistance program is taking applications through April 30 to help renters and homeowners pay for past or future energy use.

Benefits are calculated on a number of things, including household income, energy costs, and housing type. This allows those households with the lowest incomes and highest energy costs to receive the highest benefits. Applications are taken through our Community Services Offices throughout Hillsborough and Rockingham Counties. Households can also apply for and receive electrical assistance at the same appointment, if eligible.

Governor Sununu and New Hampshire Insurance Department Team Up With Healthcare Navigators and Other Stakeholders to Kick Off Healthcare.gov Marketplace Open Enrollment Period

CONCORD, NH (November 1, 2021) – The New Hampshire Insurance Department (NHID), Department of Health and Human Services (DHHS), Southern New Hampshire Services, First Choice Services and Health Market Connect today kicked off the Healthcare.gov Marketplace Open Enrollment Period.

The Open Enrollment Period for Granite Staters newly-purchasing or changing their Affordable Care Act (ACA) individual health coverage for 2022 runs from Monday, November 1, 2021 through Saturday, January 15, 2022.